What the banks don’t want you to know about creditor mortgage insurance:

1) Creditor insurance programs do not contractually guarantee rates. The insurer may increase their rates or even cancel the policy with only 30 days notice, leaving you unprotected.

2) The amount of coverage you have decreases every time you make a mortgage payment meaning you pay the same premiums month to month but the amount you are covered for continuously decreases.

3) Coverage terminates when your mortgage is paid in full but you may still need coverage. You’ll be older and the insurance premiums will likely cost you more if you are still insurable.

4) Creditor mortgage coverage does not give you the option of taking the death benefit in a lump sum payment and continuing to pay the mortgage, which may be advantageous in a rate-increasing environment.

5) The underwriting for creditor insurance happens at the time of claim…. YES, AFTER IT’S TOO LATE! The big banks will tell you that creditor insurance is a good option to people who have been declined for other types of insurance but the truth is, they will almost always take your premiums but you won’t know if you are really covered until after its too late.

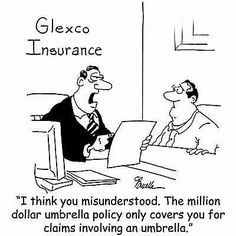

Insurance can be a confusing topic but it’s very worth your while to understand what you are getting into. CBC Market Place has ran an interesting investigation into Creditor Mortgage insurance here https://www.youtube.com/watch?v=MvtcfTrPJJE and here https://www.youtube.com/watch?v=CanwSISE1wk.

Insurance is a safety net for when the unexpected happens. Life insurance offers a way for your family to continue living comfortably and without worry in a difficult time. Call us today and we can help you get a protection plan in place!